Voluntary Benefits

Published by Trustmark Voluntary Benefits on May 4th, 2023

A lot has been said about the “care crisis” - with good reason too. Many of my colleagues have had plenty to say about the situation and Trustmark has dedicated significant resources to outlining the challenges presented by the need for care.

But, there is another lens through which we need to consider the care crisis: retirement. While it’s certainly fair to say that one of the challenges of the care crisis is that many Americans aren’t thinking about their need for care, the same can’t be said for retirement. People DO think about their retirement. And, if they’re thinking about retirement, they should be thinking about care. Let’s look at a few numbers to start to show why.

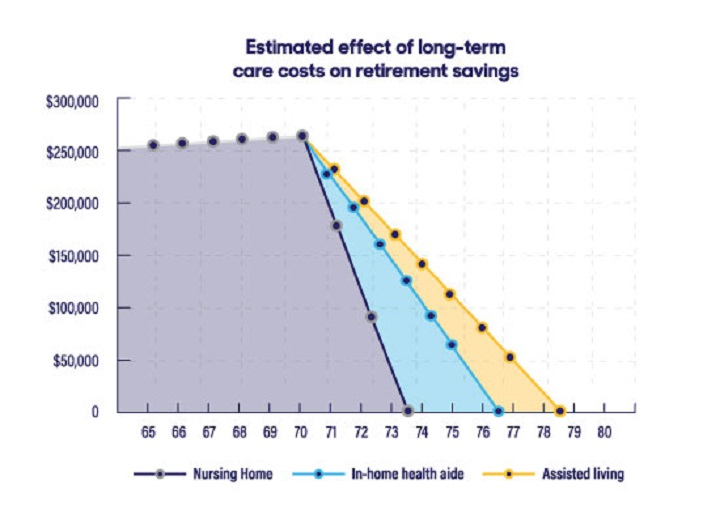

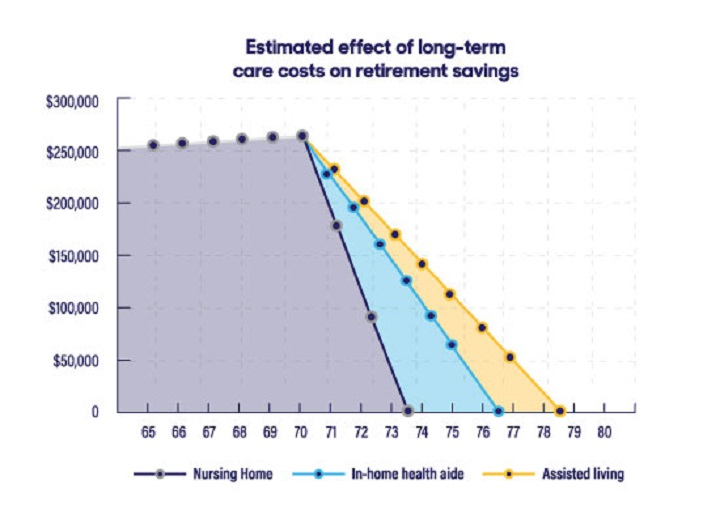

But, it’s when you start to look at the numbers for the costs and likelihood of care that things can get really challenging. According to the Genworth Cost of Care Survey4:

What’s extra scary about this chart? We’re not even factoring in the costs of living, let alone travel and other activities a retiree may want to enjoy. If anything, this paints a rosier picture than the truth! Within 4 years of going into a nursing home for care, a retirees finances could be completely depleted. Again, statistics say 70 percent of our age 65+ population will need long-term care. Many will face bigger challenges than this – smaller retirement savings, higher costs of care and, again, we’re not even factoring in their costs of living here.

When you do start to factor in the cost of living and really think through the implications, it starts to look downright gloomy. I like to think about retirement as taking people to age 77 (avg. life expectancy of an American)5 – for anyone who lives beyond this or has to use their savings for LTC, clearly, there can be a problem. On top of that, advancements in medicine will, hopefully, increase our life spans. That’s a great thing, but it could also result in a need to stretch our retirement savings further or lead to even greater stints in long-term care.

How can voluntary benefits help?

There’s no silver bullet to this difficult solution, but voluntary benefits can be a part of the solution in a couple important ways. First, and most obvious, products like Trustmark’s Universal Life and Trustmark Life + Care offer care benefits which can help to cover the costs of care and protect retirement savings. With Trustmark Life + Care, we can even pay benefits when a family member provides care to a policyholder (a trend that’s understandable given the costs).

On top of the added financial protection, a voluntary enrollment is the perfect time to educate and engage employees on a number of tools that, if offered, could positively impact their retirement. Whether that be encouraging 401(k) participation, care planning programs or general financial wellness education a chance to enroll voluntary is a chance to educate employees and should be taken advantage of to help employees protect their retirement.

From where I sit, the care crisis is also a retirement crisis and we should treat it as such. Because, whether employees and employers see it as a “care crisis” or a “retirement crisis”, there’s a need to act either way. It’s possible that, framed through the lens of retirement, we may be able to help raise awareness for employees and employers on this critical topic.

1 How your Retirement Savings Compare to the National Average. Forbes. 2023.

2 What is the average Social Security Check. Bankrate. 2023.

3 52% of retirees expect to pick up a part-time job to make ends meet. EBN. 2023.

4 2021 Genworth Cost of Care Survey. Genworth. 2023.

5 Vital Statistics Rapid Release. CDC. 2021.

But, there is another lens through which we need to consider the care crisis: retirement. While it’s certainly fair to say that one of the challenges of the care crisis is that many Americans aren’t thinking about their need for care, the same can’t be said for retirement. People DO think about their retirement. And, if they’re thinking about retirement, they should be thinking about care. Let’s look at a few numbers to start to show why.

- The average retirement savings is $255,200.1

- The average monthly social security check for a retiree is $1,781.2

But, it’s when you start to look at the numbers for the costs and likelihood of care that things can get really challenging. According to the Genworth Cost of Care Survey4:

- Seven out of 10 people over age 65 will require long-term care.

- The average national cost of an in-home health aide is $5,148 per month.

- The average monthly cost of an assisted living facility is $4,500.

- The cost of a private room in a Nursing Home Facility is over $9,000 per month.

What’s extra scary about this chart? We’re not even factoring in the costs of living, let alone travel and other activities a retiree may want to enjoy. If anything, this paints a rosier picture than the truth! Within 4 years of going into a nursing home for care, a retirees finances could be completely depleted. Again, statistics say 70 percent of our age 65+ population will need long-term care. Many will face bigger challenges than this – smaller retirement savings, higher costs of care and, again, we’re not even factoring in their costs of living here.

When you do start to factor in the cost of living and really think through the implications, it starts to look downright gloomy. I like to think about retirement as taking people to age 77 (avg. life expectancy of an American)5 – for anyone who lives beyond this or has to use their savings for LTC, clearly, there can be a problem. On top of that, advancements in medicine will, hopefully, increase our life spans. That’s a great thing, but it could also result in a need to stretch our retirement savings further or lead to even greater stints in long-term care.

How can voluntary benefits help?

There’s no silver bullet to this difficult solution, but voluntary benefits can be a part of the solution in a couple important ways. First, and most obvious, products like Trustmark’s Universal Life and Trustmark Life + Care offer care benefits which can help to cover the costs of care and protect retirement savings. With Trustmark Life + Care, we can even pay benefits when a family member provides care to a policyholder (a trend that’s understandable given the costs).

On top of the added financial protection, a voluntary enrollment is the perfect time to educate and engage employees on a number of tools that, if offered, could positively impact their retirement. Whether that be encouraging 401(k) participation, care planning programs or general financial wellness education a chance to enroll voluntary is a chance to educate employees and should be taken advantage of to help employees protect their retirement.

From where I sit, the care crisis is also a retirement crisis and we should treat it as such. Because, whether employees and employers see it as a “care crisis” or a “retirement crisis”, there’s a need to act either way. It’s possible that, framed through the lens of retirement, we may be able to help raise awareness for employees and employers on this critical topic.

1 How your Retirement Savings Compare to the National Average. Forbes. 2023.

2 What is the average Social Security Check. Bankrate. 2023.

3 52% of retirees expect to pick up a part-time job to make ends meet. EBN. 2023.

4 2021 Genworth Cost of Care Survey. Genworth. 2023.

5 Vital Statistics Rapid Release. CDC. 2021.